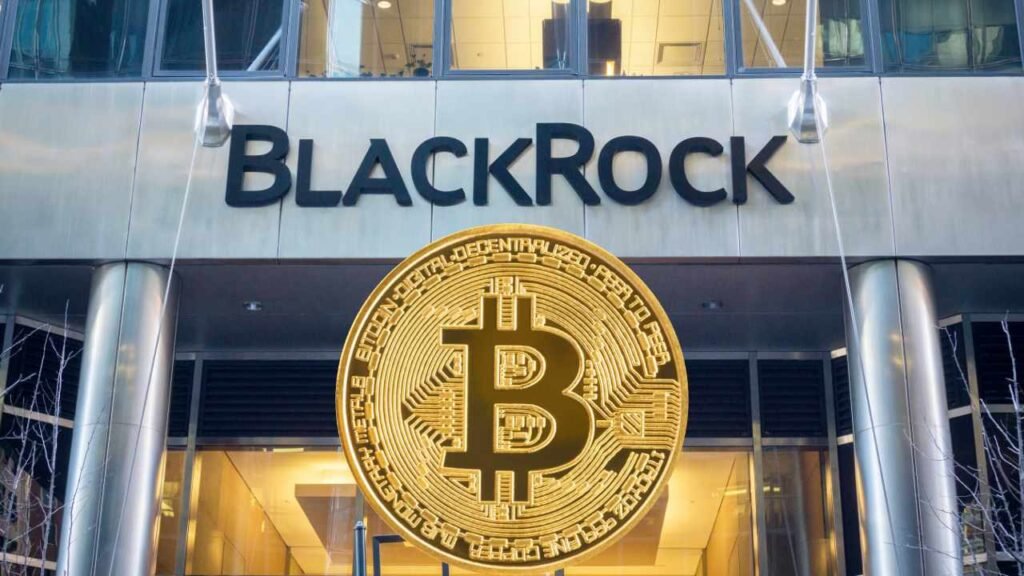

City of Roswell, New Mexico sets up a strategic Bitcoin reserve

The City of Roswell, New Mexico, established a Bitcoin strategic reserve with an initial value of $3,000 in January 2025, making it the first U.S. city to do so, as noted in a Roswell Daily Record article; this reserve grew to $2,606.123 by April 2025, reflecting Bitcoin’s market volatility. Roswell’s move aligns with its history […]

City of Roswell, New Mexico sets up a strategic Bitcoin reserve Read More »