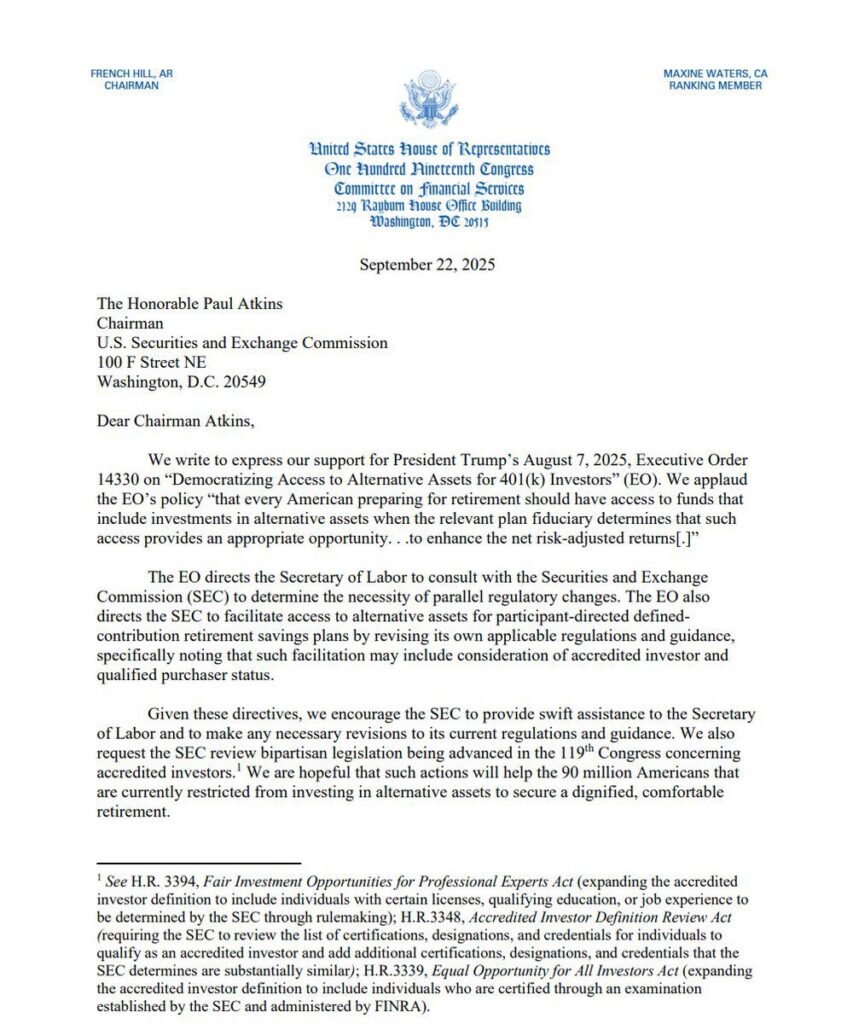

In a bold move signaling a shift in U.S. financial policy, nine Republican lawmakers from the House Financial Services Committee have urged SEC Chairman Paul Atkins to implement President Donald Trump’s August 7, 2025, executive order. The order aims to revise regulations, allowing cryptocurrency investments in the nation’s $12.5 trillion 401(k) retirement market, potentially opening the door for 90 million Americans to diversify their savings with digital assets like Bitcoin.

This proposal builds on Trump’s earlier March 7, 2025, executive order establishing a U.S. Bitcoin reserve, reflecting a growing embrace of cryptocurrency. The initiative reverses the Biden administration’s 2022 guidance, which cautioned against including crypto in retirement plans due to its notorious volatility—highlighted by an 80% annualized fluctuation rate noted in a 2018 Journal of Financial Economics study. Recent SEC approvals of crypto exchange-traded funds (ETFs) and a 2023 House bill clarifying regulatory frameworks further support this momentum.

With Bitcoin currently hovering near $63,500, analysts estimate that a 3-5% allocation from the $45.8 trillion U.S. retirement market could inject $1.37 trillion to $2.29 trillion into the crypto space. This could propel Bitcoin’s price by 61-102%, potentially reaching $181,000 to $227,000. However, the 2022 FTX collapse, which saw significant investor losses, serves as a stark reminder of the risks in this unregulated market.

Supporters argue this move democratizes access to high-growth assets, while critics warn of potential retirement savings erosion due to crypto’s instability. As the debate unfolds, the financial world watches closely, with the outcome likely to shape the future of retirement investing in the digital age.