Bitcoin didn’t break through the crucial level, as of yet.

According to M2 supply, the breakout is around the corner. I suppose that Q2 is still going to be a good period for Crypto.

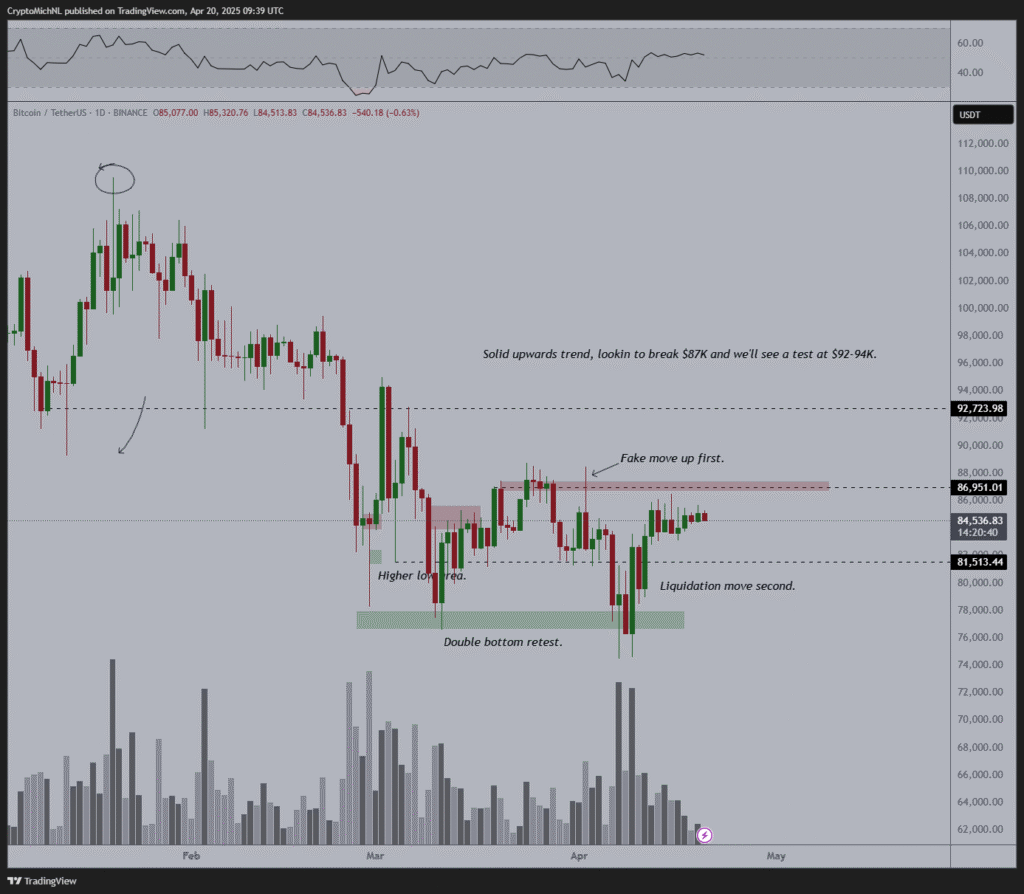

Michaël van de Poppe, a trader at the Amsterdam Stock Exchange, analyzes a Bitcoin chart showing a “double bottom” pattern, a bullish reversal signal where the price tests a support level twice (around $82,500) before rising, indicating potential upward momentum.

He links Bitcoin’s price to M2 money supply growth, noting historical correlations where increased liquidity (M2 growth) often drives Bitcoin prices higher, as seen in 2020-2021, supported by data from Sarson Funds showing Bitcoin’s sensitivity to global monetary policies.

The chart also marks a “fakeout” at $90,000, where Bitcoin briefly broke resistance but fell back, suggesting sellers defended that level; van de Poppe predicts a breakout soon, aligning with optimism for Q2 2025 crypto performance despite Q1 challenges.