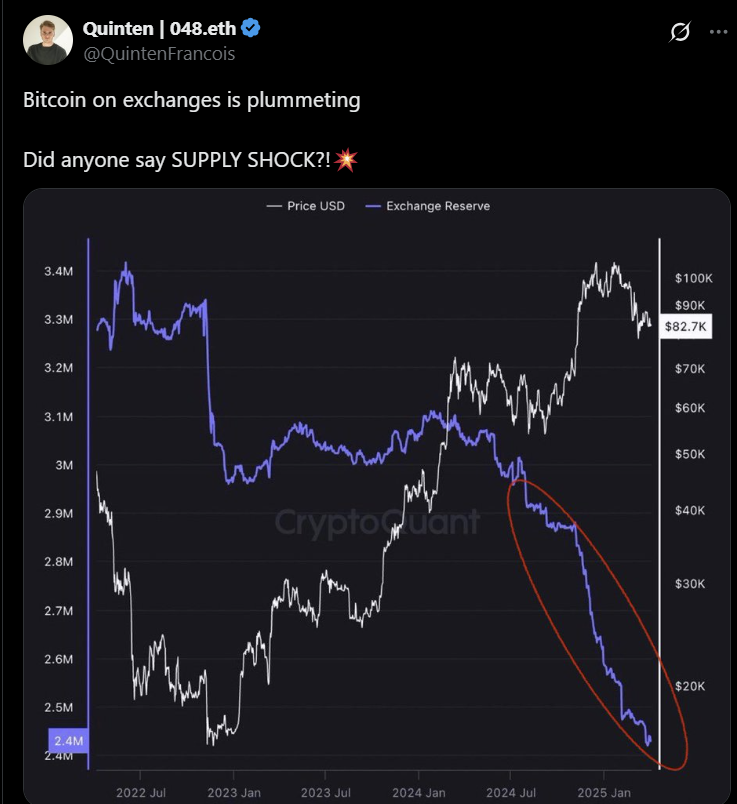

The X post by QuintenFrancois highlights a significant drop in Bitcoin exchange reserves, from 3.2 million BTC in 2022 to around 2 million BTC by early 2025, as shown in the CryptoQuant chart, signaling a potential supply shock that could drive prices higher due to reduced sell-side liquidity.

This trend aligns with historical data; for instance, Bitcoin reserves on exchanges fell to 2018 levels (2.58 million BTC) by September 2024, a decrease of 430,000 BTC year-to-date, often interpreted as a bullish sign of long-term holding over short-term trading [].

The post’s timing coincides with a weakening U.S. dollar, with the ICE U.S. dollar index hitting its worst day since 2022 on April 13, 2025, potentially boosting Bitcoin’s price as a safe-haven asset amid a looming dollar “confidence crisis”.